For many credit unions and banks, loan origination remains a labor-intensive process filled with manual reviews, data entry, and subjective decision-making. Agentic Automation changes that.

With UiPath Maestro and Greenlight’s end-to-end agentic framework, your organization can transform how loan applications are processed, combining AI agents, orchestration, and human oversight to achieve faster, more accurate outcomes.

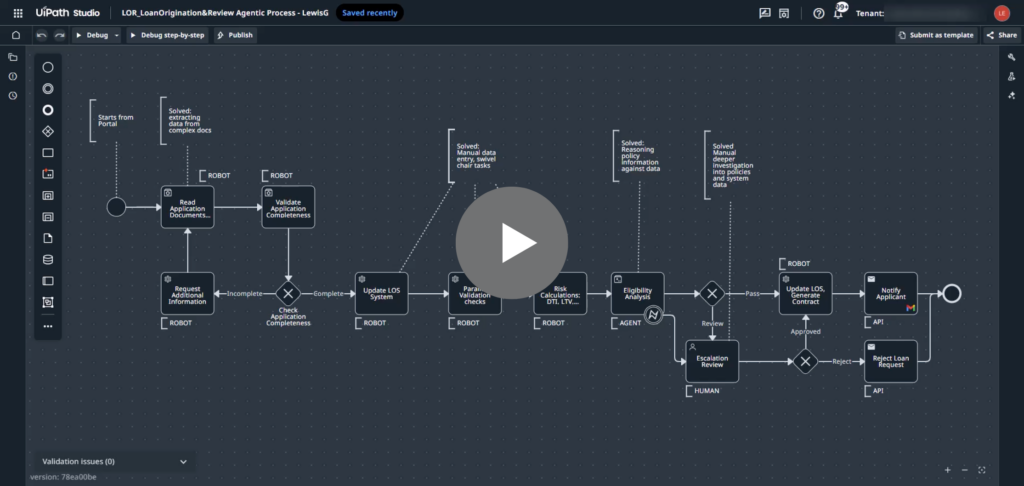

Inside the Agentic Workflow

In a traditional loan origination process, your team might spend hours reviewing financial statements, verifying documents, and calculating eligibility. By integrating agentic automation, you can orchestrate those steps intelligently in UiPath Maestro.

It begins with document ingestion. UiPath IXP reads unstructured and semi-structured financial documents such as income statements, brokerage reports, and property records. The system extracts key details like ID verification, property type, and financial data, and validates their completeness. If information is missing, the applicant automatically receives a request to provide the missing details before the process continues.

Next, the system updates your Loan Origination System (LOS) and performs consistency checks to ensure everything aligns. Once the data is clean and complete, the workflow runs a risk assessment, evaluating creditworthiness, affordability, and other financial indicators, all in one seamless flow.

At this stage, most institutions still rely on a human loan officer to interpret the data. In an agentic model, that role is supported or even enhanced by an AI-driven Loan Eligibility Agent.

What is a Loan Eligibility Agent?

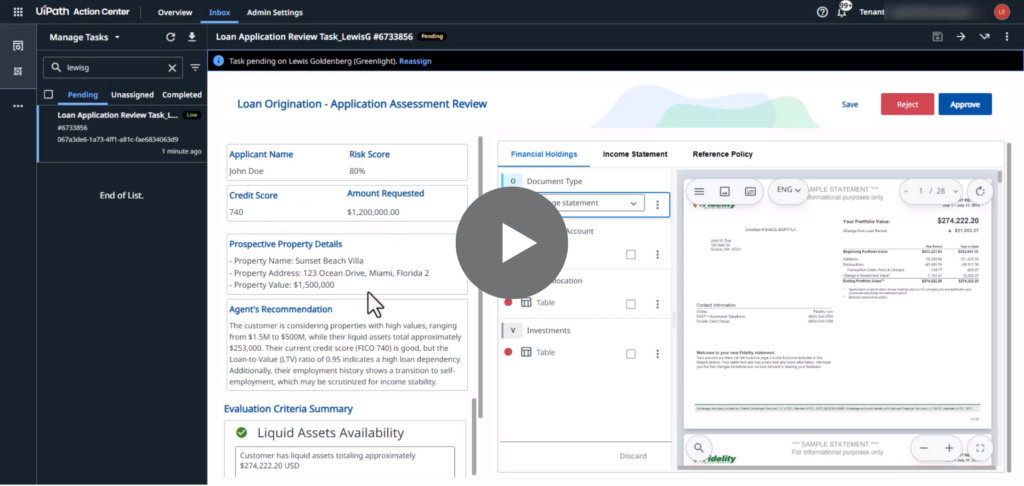

Your Loan Eligibility Agent acts as an intelligent decision-maker at the heart of the process. Powered by the AI model of your choice, the agent combines predictive analytics, contextual understanding, and financial policy adherence to recommend loan approvals or rejections with full transparency.

It draws on:

- Credit, employment, and property data pulled from connected systems

- Context grounding from your organization’s own loan policy documentation

- Real-time affordability and risk calculations aligned to your business rules

From there, the agent produces a recommendation report that includes:

- A suggested loan type

- A risk score from 0-100

- The reasoning behind its decision

If the agent encounters incomplete or conflicting data, or a particularly complex case, it automatically escalates to UiPath Action Center, where your loan officers can review the case, validate the recommendation, and make the final call. This balance ensures your team retains control over high-value or high-risk applications while allowing automation to handle the routine.

Automation → Orchestration

Once a decision is confirmed, either by the agent or by your reviewer, the rest of the process continues automatically. UiPath Maestro updates your LOS, generates the loan contract, and sends a notification (with attachments) directly to the applicant. Each loan becomes an independent, auditable transaction within Maestro, complete with retry capabilities, detailed logs, and real-time visibility. Even if a system goes down, you can restart the process exactly where it left off, without losing progress or data integrity.

The Business Impact

Agentic Automation offers both immediate efficiency and long-term strategic advantage for financial institutions ready to modernize lending operations.

Efficiency at Scale: Automating document extraction, validation, and decision-making cuts processing times from days to minutes helping your team handle higher volumes during busy cycles without additional headcount.

Enhanced Accuracy and Compliance: Integrated validation and policy context minimize manual errors while ensuring every decision complies with internal lending policies and external regulations.

Improved Transparency and Trust: Each agentic recommendation includes clear reasoning, improving audit readiness and equipping your staff to make well-informed final decisions.

Future-Ready Architecture: Because UiPath Maestro orchestrates both humans and agents, you can extend this same architecture beyond loan origination to credit underwriting, mortgage renewals, and account servicing.

Rethinking the Loan Officer

Agentic Automation isn’t about replacing expertise, it’s about amplifying it. By taking on repetitive tasks and surfacing structured insights, the system empowers your loan officers to focus on higher-value conversations, relationship-building, and complex financial decisions. It’s a modern, balanced model: AI drives efficiency, humans drive trust.

A Smarter, Safer Way Forward

Agentic Automation represents a practical path to operationalizing AI. With orchestrated agents, real-time insight, and built-in governance, your institution can move confidently from pilot to production and see results faster.

Greenlight Consulting helps financial organizations design and deploy end-to-end agentic solutions built on UiPath Maestro. Are you ready to reimagine what your lending process could look like? Schedule a consultation with us today.