Loan origination remains one of the most manual, error-prone, and resource-intensive processes in consumer banking. Fragmented systems, document-heavy workflows, and rising compliance demands slow approvals, frustrate borrowers, and strain lending teams.

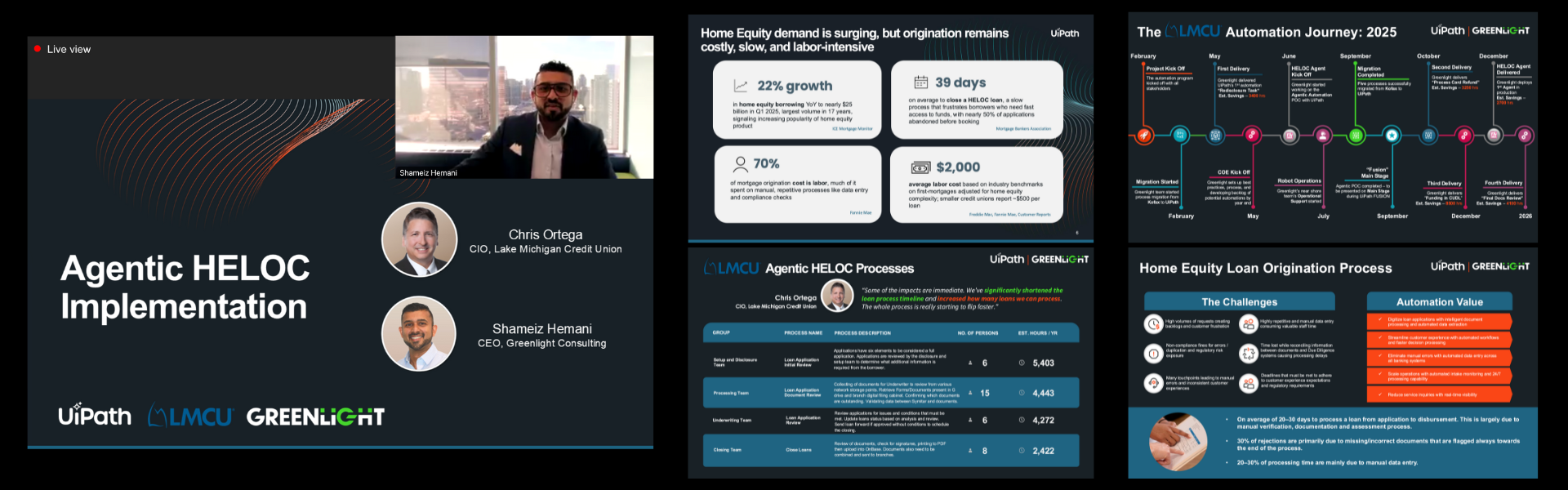

Hosted by American Banker, this webinar features Lake Michigan Credit Union (LMCU), UiPath, and Greenlight Consulting as they share how agentic automation is transforming loan origination end-to-end—coordinating AI agents, automation, and people to streamline application intake, document processing, underwriting support, and compliance.

You’ll see how this approach applies across consumer loans, including products like HELOCs, where automation delivers outsized impact.

What You’ll Learn

- Why traditional loan origination models can’t keep up with today’s volume, complexity, and borrower expectations

- Where automation delivers the fastest wins across the loan lifecycle

- How agentic orchestration improves speed, accuracy, and compliance without disrupting your LOS

- How regional banks and credit unions are modernizing lending operations with pre-built automation solutions

See how agentic automation is redefining loan origination—and learn how your institution can move from application to approval faster.